Designing a fintech, not a bank.

A common theme in the fintech space recently is how "the world doesn't need another Neo-bank". Sure, Europe and the U.S. might have indeed reached the saturation point in terms of challengers, the world at large does need more financial apps. More importantly, I think the definition of what's a bank and what's a fintech has clearly expanded in the last few years, creating plenty of opportunities to design something new.

Now, the banking stack is indeed pretty commoditized. In my previous job at Adyen I helped build what's - in my admittedly biased opinion - one of the best neo-banking platforms around, and now at Wise I work on expanding our global multi-currency account.

Both Adyen and Wise have had a significant head-start in building a competitive feature set, and both have significant distribution channels: Adyen can piggyback on a supremely impressive array of business customers, and Wise already had 8M+ users when it started issuing cards.

Yet, that doesn't make it impossible for new challengers to emerge: they would just have to be something else than neo-banks. And sure enough, a growing array of non-financial, non-neobank products have started emerging - with Cleo, Plum, Cake and Emma amongst the most interesting ones in my personal opinion.

For a change, instead of breaking down an existing product (which would be unfair, as my work consists of building the stacks for these services), I decided to put on my product designer hat and think - 'if I were to start a fintech startup without having a banking license and without directly integrating with the financial stack, what would I build?'.

What I came up with - let's call it the Payingforward App - consists of four core pillars: pay, assets, grow and earn.

Pay

One of the biggest changes challenger banking brought along is the proliferation of multiple cards in the average user's wallet. Apps like Curve act as aggregators of other debit cards, being notably limited to VISA and Mastercard cards. Curve's strategy is to get you to proxy spend of all of your third party cards through their own Curve Card. For this they pay to acquire an e-commerce transaction on your third party debit cards (usually capped at 0.2% + scheme fees), pay the issuing scheme fees to the scheme, and get paid the interchange for their own card - most likely subsidizing this whole passthrough operation using VC money or scheme kickbacks now the commercial interchange loophole is gone.

I think there is a way to make Curve's business model work, and it's basically by offering true aggregation to customers (i.e. not just VISA/Mastercard debit cards), and pay for it via a membership fee. That's what Payingforward App would hypothetically do, by aggregating all of your expenses in one place, enticing you to spend through Payingforward's virtual wallet cards using rewards or discounts, and pay for external spending with a subscription fee.

True aggregation would have to come via either proxy spending (already feasible), or via an extension of open banking (foreseeable future) - when this happens, Pay would truly become a commoditized feature.

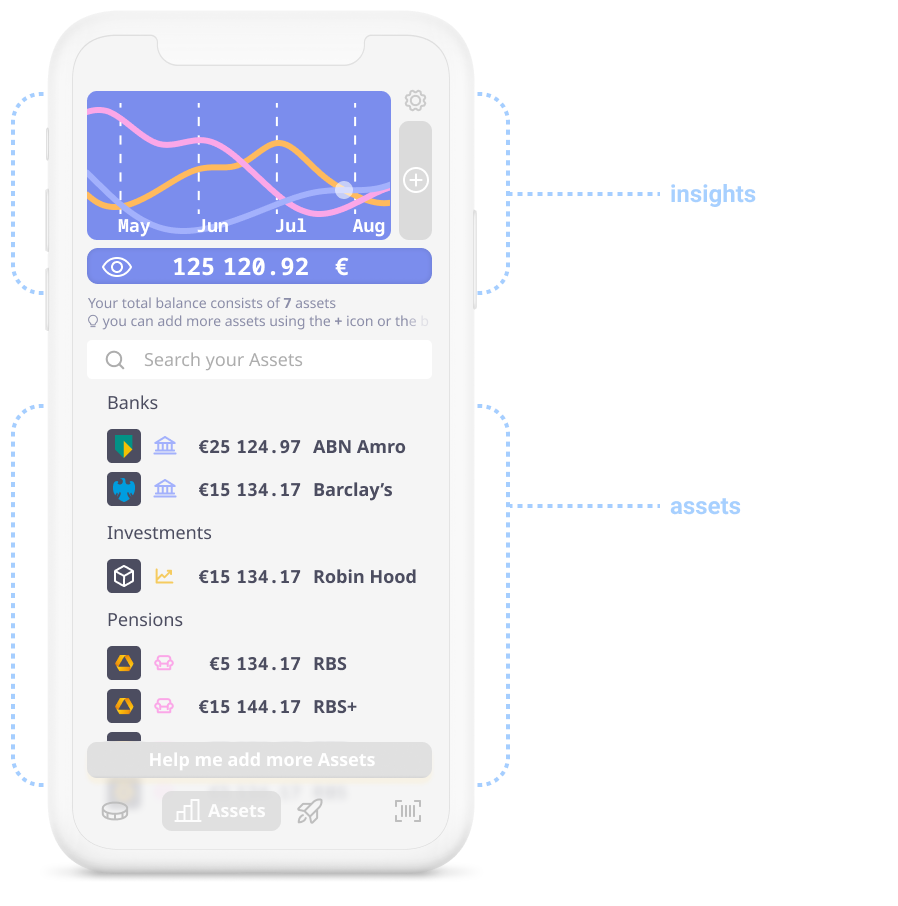

Assets

There's plenty of different apps allowing you to invest. Insights for banking have long been a staple of fintech apps like Revolut, N26 or Wise. Insights and investments are at the core of Robin Hood or Bux or DeGiro, and there's plenty apps offering pension funds and safe investments as well.

What is still complicated, however, is tracking all of your assets in one place. Apps like Emma work brilliantly in aggregating some of your stuff, but aside from that there's been a notable dearth of interoperability.

That shouldn't be: most of the banking data is now easily accessible via open banking - with alternative data available either via APIs or, more often, screen scraping.

How to monetize this is clear: having primary access to the customer's next investment decision ('help me add more Assets') would allow Payingforward App to act as an investment vehicle platform - much like Raisin does in Europe - effectively becoming an asset gateway.

Grow

A lot of people - and not just millenials - are very unfamiliar with how investing works. Most notably taxes, compounding, asset distribution and retirement plans are the great unknown for a large slice of the population. Apps like Hatch (recently acquired by Octopus) have tried to crack that nut, but the untapped potential of investment planning remains large. If Payingforward App were to go down that route, it would have first pick on offering freeform advice to its customers, de facto steering them in the right direction.

Loans are always controversial - with fintechs like Zopa or Fronted offering to front money with low friction but at high APR. Others, like Cleo, go down the advance payment road, with much lower loan amounts but also lower APRs In the spirit of simplicity, Payingforward App would most likely not have a lending partner or a fintech lending license, instead acting as an aggregator for existing services - letting users choose the optimal trade-off between low interest and high amounts.

Budgeting and jars are some of the most effective way to teach people to manage their finances. Yet most banks (logically) offer jars as a way to separate your money - not to make risk-free interest on it. Apps like Plum pay nominal interests on jars - therefore incentivizing people to store more money in jars.

Finally, subscriptions and bills are some of the ways people tend to lose track of their money - something that will only increase now with the proliferation of buy now, pay later schemes. Energy, insurance and internet switching programs could be a significant driver for Payingforward App to get some kickbacks from brokers in exchange for a fair comparison - a win-win situation.

All this would allow users to consolidate their debts, reduce their expenses and approach investing, ultimately growing their nest through third parties, but tracking it all in a single place.

Earn

The final piece of the puzzle is allowing users to directly benefit from an app that would most likely cost a certain amount per month. Similar to apps like Emma, Cleo or Cake, it should ultimately be clear to the users where they are benefitting from.

Easy cashbacks - based on promotions with participating merchants - and the ability to get paid quickly, either as a business or as a P2P-friendly setup, directly on a third party bank account, would make up the supply side of the Payingforward App, allowing users to earn.

Wrapping up

So, how realistic is all of this? Ultimately this hypothetical Payingforward App would need to support a large number of third party integrations, and figure out for each single feature how to monetize and be profitable while reserving enough money to pay the ecosystem for its services. Distribution would, of course, be a significant challenge in an overly saturated market.

More than anything then, this is an exercise in cataloguing the wide set of features for which there is real user demand and that an hypothetical challenger would be able to offer without going through lengthy, expensive licensing processes. Indeed, a stub of the Payingforward App could be launched by a true handful of people - something that would have been impossible just a few years back.

And sure enough, more and more useful fintech apps that are not traditional challenger banks are entering the space - some of which I've mentioned in this article, and undoubtedly more in the months and years to come, supported by established players like Wise and Adyen.

The world might not need another challenger fintech, but it does need a fintech ecosystem. And as the Payingforward App experiment proves, we're definitely moving towards a very advanced state for that.